Euro Vision 2030 is an integrated initiative by REAL CHANGE LTD-PK/BG to expand economic connectivity, infrastructure, and humanitarian impact across three regions: South Asia, the Middle East, and Europe. The initiative focuses on: Launching a Pakistan to Central Europe freight train corridor (Islamabad ® Vienna) Investing USD 40M in Saudi Arabia (plastics manufacturing, NEOM, Muqaab real estate) Scaling trade and real estate projects in the EU, positioning Vienna as a central hub Delivering humanitarian aid and reconstruction assistance for Gaza

Key Benefits:

⦁ Faster, more reliable land transit between South Asia and Central Europe (competitive alternative to long sea legs).

⦁ New manufacturing/export base in Saudi Arabia targeting African markets, leveraging Jeddah’s port & logistic links.

⦁ Leveraging EU market access (GSP+ and textile demand) and Vienna’s logistics advantage to grow Pakistan → EU textiles & tourism links.

Project 1 — Pakistan to Central Europe Freight Train Project (Islamabad ® Vienna)

This project envisions a high-capacity freight train linking Islamabad with Vienna via Iran, Turkey, and Eastern Europe. It reduces transit time compared to sea freight, strengthens Pakistan–Europe trade, and positions Vienna as a logistics hub.

Vision & objectives

Establish a regular freight service and associated logistics chain connecting Islamabad to Vienna to:

⦁ Reduce transit time versus sea (example corridors show potential in under 10–14 days for comparable routes).

⦁ Open faster supply chains for textiles, perishables, industrial goods and higher-value engineered products.

⦁ Position Vienna as transhipment/logistics hub for distribution into EU & CEE.

Route options & maps (conceptual)

Likely corridor options (each has pros/cons):

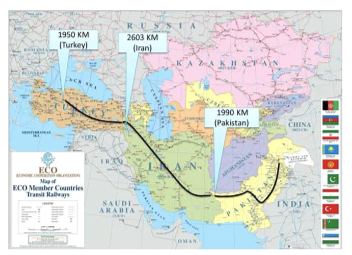

⦁ South route (ITI corridor): Islamabad → Quetta / Zahedan → Tehran → Ankara → Istanbul → Bulgaria/Serbia → Hungary → Austria (Vienna). Uses Pakistan–Iran–Turkey Istanbul-Tehran-Islamabad (ITI) corridor frameworks recently revived.

⦁ Northern route (through Central Asia / Russia): Islamabad → (via northern borders / new links) → Central Asia → Russia → Central Europe (longer, more complex but useful for some cargo).

Technical & operational prospects

⦁ Distance & transit time: ITI corridor operations report ~6,540 km segments and pilot services that can cut transit to ~10 days on some legs compared to ~30–40 days by sea. Realistic Islamabad→Vienna transit window: 10–16 days with optimized operations and transhipments.

⦁ Gauge & interoperability: Iran/Turkey/EU use standard gauge; Pakistan uses broad gauge (1,676 mm). Transhipment or bogie change will be required at gauge-break points (common rail logistic challenge). Plan: container swap hubs and well-equipped transhipment yards at border nodes.

⦁ Rolling stock & terminals: Dedicated intermodal wagons, refrigerated units for perishables, and container block-trains. Secure multi-modal terminals needed at Islamabad, Quetta/Chaman (or Zahedan link), Istanbul and Vienna. Austria already expanding intermodal capacity near Vienna.

Economic impact & cargo types

Primary cargo categories:

⦁ Textiles & garments (highest existing Pakistan → EU share).

⦁ High-value manufactured components, perishables (fruits, seafood), automotive parts, chemicals (non-hazardous), machinery spares.

Benefits:

⦁ Faster lead times → higher landed-value goods shipped by rail.

⦁ Reduced inventory & working capital for buyers in Europe.

⦁ New trade corridors for Central Asian trade via Pakistan ports.

Regulatory, customs & border issues

⦁ Need bilateral/multilateral agreements: single-window customs facilitation, harmonised documents, corridor One-Stop-Shop (C-OSS) models used in EU corridors.

⦁ Security protocols for high-value cargo; insurance arrangements; rules of origin documentation for GSP+ benefits must be observed for textile exports.

Commercial model, capex & financing (high-level)

⦁ Phases: feasibility (0–6 months) → pilot corridor (6–18 months) → scale (18–60 months).

⦁ Estimated capital needs (indicative): terminal upgrades + transhipment yards + rolling stock pool + IT systems ≈ USD 50–250M depending on scope and whether partnering with national railways / private logistics investors. (This is a conceptual estimate — project scoping required for accuracy.)

⦁ Revenue sources: haulage fees, terminal handling, warehousing, value-added services (customs clearance, consolidation, insurance).

⦁ Financing: mix of equity (private investors like REAL CHANGE, concessional loans (multilateral banks), public-private partnerships.

Risks & mitigations

⦁ Political/geo-risk at border regions — mitigation: phased implementation, insurance, diplomatic engagement.

⦁ Gauge & technical interoperability — mitigation: invest in efficient transhipment hubs and fast bogie-change facilities as interim.

⦁ Volume risk — lock in anchor contracts with large textile exporters/importers and freight forwarders; offer time-sensitive pricing

Project 2 — Kingdom of Saudi Arabia Investment Program (USD 10M)

REAL CHANGE LTD plans to establish a plastic dots manufacturing factory in Jeddah, targeting African markets through Red Sea logistics. Additionally, investments will be made in NEOM city and the Muqaab mega development in Riyadh to capture long-term real estate value.

A. Jeddah plastic-dots factory — concept

Objective: Establish a specialized plastics facility near Jeddah producing plastic dots / pellets / polymer components for packaging and assembly used in African markets (fast-moving consumer goods, construction, agriculture). Jeddah advantage: access to Red Sea ports, proximity to African markets (East & Horn of Africa), industrial zones.

Project 2 — Kingdom of Saudi Arabia Investment Program (USD 10M)

REAL CHANGE LTD plans to establish a plastic dots manufacturing factory in Jeddah, targeting African markets through Red Sea logistics. Additionally, investments will be made in NEOM city and the Muqaab mega development in Riyadh to capture long-term real estate value.

A. Jeddah plastic-dots factory — concept

Establish a specialized plastics facility near Jeddah producing plastic dots / pellets / polymer components for packaging and assembly used in African markets (fast-moving consumer goods, construction, agriculture). Jeddah advantage: access to Red Sea ports, proximity to African markets (East & Horn of Africa), industrial zones.

Market rationale

⦁ Saudi plastics & packaging market is large and growing; Jeddah is a manufacturing/logistics node; Africa import demand for plastic components is rising.

⦁ Vertical integration: source imported feedstock (polyethylene/polypropylene) or local procurement from KSA petrochemical supply chains.

Proposed plant (USD 10M allocation example)

⦁ Capex breakdown (example):

⦁ Plant & equipment (extruders, molding lines): USD 4.5M

⦁ Land & factory fit-out (industrial zone in Jeddah): USD 1.5M

⦁ Working capital (raw materials, staffing): USD 1.0M

⦁ Packaging, QC labs, certifications (ISO, SGS): USD 0.5M

⦁ Logistics & initial export setup (containers, cold chain if needed): USD 1.0M

⦁ Business development, marketing, legal: USD 0.5M

⦁ Contingency (10%): USD 1.0M

⦁ Outputs: capacity to produce several thousand tonnes/year depending on product mix; target margins depend on product complexity. (Detailed financial model required.)

Sales & distribution

⦁ Export lanes: Jeddah → Port Sudan, Djibouti, Mombasa, Dar es Salaam → regional distribution. Also serve Gulf market.

⦁ Competitive edge: lower lead times into African markets, Saudi logistics, ability to meet GCC regulations.

B. Real estate investments — NEOM & Mukaab / New Murabba / Muqaab contexts

⦁ NEOM: large futuristic development with special economic incentives; real estate here may require high entry capital and strategic partnerships (PIF involvement, licensed developers).

⦁ Mukaab / New Murabba (Muqaab): The Mukaab is a mega development in Riyadh’s New Murabba district — huge scale and national priority (Vision 2030). It presents opportunity in hospitality, serviced apartments, retail JV opportunities with local developers.

Strategy for REAL CHANGE: For USD 10M:

⦁ Take minority equity stakes in smaller off-plan developments near NEOM (through licensed Saudi partners) or invest in developer debt/joint ventures focused on worker housing, mid-market hospitality, or logistics/warehousing servicing NEOM & Red Sea ports.

⦁ Consider short/medium term options (land banking + pre-sales) or longer-term JV stakes for higher upside.

C. Investment structure & governance

⦁ Use a PK/BG-registered SPV (REAL CHANGE LTD-PK/BG Saudi Branch / JV).

⦁ Local sponsor / Saudi partner for licensing, Saudisation compliance, and PIF/municipal approvals.

⦁ Governance: local Board rep, compliance officer, and in-country operations manager.

Project 3 — EU Investment Projects (Austria, Italy, Germany, Spain)

Focus on tourism, real estate, and textiles exports from Pakistan. Vienna will serve as the strategic hub for EU distribution and business expansion

Strategic goals

⦁ Tourism: invest in boutique properties, tour packages linking Pakistani cultural tourism with European circuits (pilgrimage, cultural festivals).

⦁ Real estate: targeted acquisitions in secondary cities and rental housing near logistic hubs (Vienna region recommended).

⦁ Textiles & exports: build vertically integrated fabrics → finished garments export channel to EU buyers; use Vienna hub for distribution.

Why Vienna as the European hub

⦁ Austria (Vienna region) is a central logistics junction with strong rail, road, air links to Central & Eastern Europe; expanding intermodal freight capacity (e.g., Vienna South expansion). A Vienna hub reduces last-mile complexity into EU markets.

⦁ Austria is investing in rail modernization and positioning to be a European rail hub — advantageous for the Islamabad→Vienna freight link.

Textile exports — opportunity

⦁ Textiles and clothing make up a large share of Pakistan’s exports to the EU (over 70% of Pakistan → EU imports are textiles). Pakistan exported multiple billions to EU markets recently; demand recovering and benefiting from GSP+ preferences.

⦁ Strategy: set up a Vienna regional distribution center for Pakistan-made garments (quality control, labelling, light alteration/packaging, quick delivery to major EU retailers in Germany, Spain, Italy).

Sample project portfolio (examples)

⦁ Austria (Vienna) — Intermodal warehousing + distribution center (5,000–10,000 sqm) to act as EU consolidation hub. Benefit: close to rail terminals and freight corridors.

⦁ Italy (Milan/Tuscany) — Tour operator JV, boutique hotels linked to high-value tourism packages from Pakistan to Italy.

⦁ Germany (Hamburg/Frankfurt) — Textile trade office & showroom; tie-ups with German distributors.

⦁ Spain (Barcelona/Madrid) — Logistics link for southern EU markets; textiles and fashion shows for Pakistan designers.

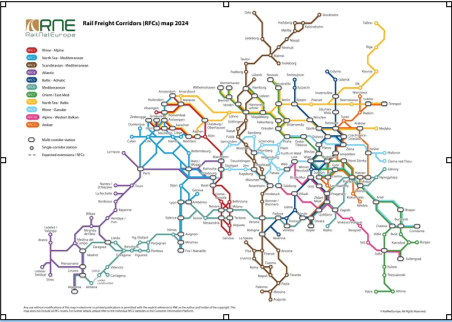

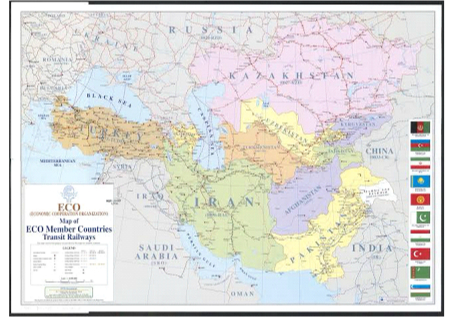

5. Visual annex (illustrative)

⦁ Pakistan rail network map (illustrative).

⦁ Conceptual route map Islamabad → Vienna via ITI corridor and onward.

⦁ EU freight corridors & Vienna intermodal hub graphics.

⦁ NEOM / Mukaab / New Murabba press visuals (for reference in SA real-estate planning).

(Images above are illustrative; for company marketing materials we recommend commissioning high-resolution custom maps and branded renders.)

6. Action plan & next steps for REAL CHANGE LTD-PK/BG (concrete immediate steps)

Phase A — 0–3 months (mobilize)

⦁ Approve the Euro Vision 2030 concept and seed budget for feasibility studies (suggest USD 150–300k for studies + legal due diligence across corridors & SA investments).

⦁ Appoint project leads: (a) Rail corridor director, (b) KSA investments director, (c) EU business director (Vienna).

⦁ Commission two feasibility studies: (i) Islamabad→Vienna rail feasibility (routes, tranship points, cost model), (ii) Jeddah plastics factory market/technical feasibility.

Phase B — 3–12 months (pilots & partnerships)

⦁ Negotiate MoUs with Pakistan Railways and relevant private rail operators / logistics providers; engage Iran/Turkey corridor stakeholders as needed.

⦁ Incorporate Saudi JV/SPV and identify industrial land/zone in Jeddah; start local partner selection.

⦁ Open Vienna liaison office (or partner with logistics provider) to start lease negotiations for intermodal space.

Phase C — 12–36 months (build & operate)

⦁ Commence pilot freight services and trial shipments, begin factory construction in Jeddah, and finalize EU hub setup.

Commercial attachments (what REAL CHANGE LTD must prepare)

⦁ One-page project pitch for each initiative (rail corridor, Jeddah factory, Vienna hub).

⦁ Detailed financial models (Capex/Opex/IRR) — we can prepare templates.

⦁ Investor memorandum and term sheets (for JV and debt/equity fundraising).

Project 4 — Humanitarian Aid & Assistance in Gaza

REAL CHANGE LTD aims to collaborate with official Arab and Palestinian authorities (recognized by U.S. and EU) to deliver food aid via Egypt, and support post-conflict development projects after a peace process.

⦁ Project 4 — Humanitarian Aid and Assistance in Gaza

⦁ Partnership with official Arab authorities & Palestinian authorities recognized by U.S. & EU

⦁ Food supply chain via Egypt (Rafah border corridor)

⦁ Long-term development & reconstruction aid after peace process

⦁ Visuals: humanitarian relief, aid logistics maps, diplomatic framework

⦁ Action Plan & Roadmap (2025–2030)

⦁ Phases: Feasibility → Pilots → Scale-Up

⦁ Budget outline and investment timeline

⦁ Governance and compliance (EU, Saudi, Arab coordination)

Action Plan & Roadmap (2025–2030)

Phase 1 (2025–26): Feasibility and pilots.

Phase 2 (2027–28): Expansion of Saudi investments and EU hub operations.

Phase 3 (2029–30): Full-scale freight operations, regional integration, and sustained humanitarian programs.

As a highly exclusive lobbying firm, we offer our clients a level of service that is unmatched in the industry. We work with a select group of clients who demand the highest level of professionalism, discretion, and expertise. Our team consists of top-tier professionals with extensive experience in government relations, public policy, and strategic communications. We provide our clients with personalized, white-glove service, and we are dedicated to achieving their goals and objectives. We work tirelessly to build and maintain relationships with key decision-makers and influencers, and we leverage our extensive network to deliver results.

We’re here to help! Join the Real Real Change. Be the Real Real Change. Together, let’s make a difference!